Your online, mobile, and social behaviour are now data-points used by fintech startups and governments in scoring credit-worthiness

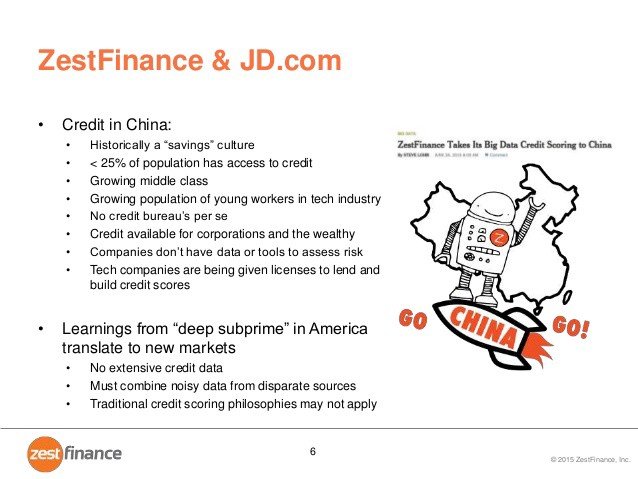

In the new issue of “Money Of The Future” annual fintech report, we can see that partnership between Baidu and ZestFinance is just one of several provincial-level or private pilot programs in China’s push to develop a nationwide social credit system. The current implementations are currently unconnected, but may ultimately be combined under government leadership.

Part financial credibility indicator and part compliance mechanism, the social credit system aims to generate a score for individuals and institutions in China based on data like tax filings and driving demerits. And while consumers may reap rewards, the score also functions as a signal mechanism for authorities about whom or what deserves to be penalised.

Imagine a world where an authoritarian government monitors everything you do, amasses huge amounts of data on almost every interaction you make, and awards you a single score that measures how “trustworthy” you are. In this world, anything from defaulting on a loan to criticising the ruling party, from running a red light to failing to care for your parents properly, could cause you to lose points. And in this world, your score becomes the ultimate truth of who you are — determining whether you can borrow money, get your children into the best schools or travel abroad; whether you get a room in a fancy hotel, a seat in a top restaurant — or even just get a date.

As Independent wrote, it could be China by 2020. It is the scenario contained in China’s ambitious plans to develop a far-reaching social credit system, a plan that the Communist Party hopes will build a culture of “sincerity” and a “harmonious socialist society” where “keeping trust is glorious.”

A high-level policy document released in September listed the sanctions that could be imposed on any person or company deemed to have fallen short. The overriding principle: “If trust is broken in one place, restrictions are imposed everywhere.” A whole range of privileges would be denied, while people and companies breaking social trust would also be subject to expanded daily supervision and random inspections.

The ambition is to collect every scrap of information available online about China’s companies and citizens in a single place — and then assign each of them a score based on their political, commercial, social and legal “credit.”

Harnessing the power of big data and the ubiquity of smartphones, e-commerce and social media in a society where 700 million people live large parts of their lives online, the plan will also vacuum up court, police, banking, tax and employment records. Doctors, teachers, local governments and businesses could additionally be scored by citizens for their professionalism and probity.

“China is moving towards a totalitarian society, where the government controls and affects individuals’ private lives,” said Beijing-based novelist and social commentator Murong Xuecun

Social credit system

At the heart of the social credit system is an attempt to control China’s vast, anarchic and poorly regulated market economy, to punish companies selling poisoned food or phony medicine, to expose doctors taking bribes and uncover con men preying on the vulnerable.

Yet in Communist China, the plans inevitably take on an authoritarian aspect: This is not just about regulating the economy, but also about creating a new socialist utopia under the Communist Party’s benevolent guidance.

The Communist Party may be obsessed with control but it is also sensitive to public opinion, and authorities were forced to backtrack after a pilot project in southern China in 2010 provoked a backlash. That project, launched in Jiangu province’s Suining County in 2010, gave citizens points for good behaviour, up to a maximum of 1,000. But a minor violation of traffic rules would cost someone 20 points, and running a red light, driving while drunk or paying a bribe would cost 50.

The Baihe online dating site encourages users to display their Sesame Credit scores to attract potential partners; 15 per cent of its users do so. (Here you can find more examples of “unusual fintech” in China.)

Some of the penalties showed the party’s desire to regulate its citizens’ private lives — participating in anything deemed to be a cult or failing to care for elderly relatives incurred a 50-point penalty. Other penalties reflected the party’s obsession with maintaining public order and crushing any challenge to its authority — causing a “disturbance” that blocks party or government offices meant 50 points off; using the internet to falsely accuse others resulted in a 100-point deduction. Winning a “national honour” — such as being classified as a model citizen or worker — added 100 points to someone’s score.

On this basis, citizens were classified into four levels: those given an “A” grade qualified for government support when starting a business and preferential treatment when applying to join the party, government or army; or applying for a promotion. People with “D” grades were excluded from official support or employment.

The project provoked comparisons with the “good citizen cards” introduced by Japan’s occupying army in China in the 1930s. On social media, residents protested that this was “society turned upside down,” and it were the citizens who should be grading government officials “and not the other way around.” Or with the yellow badge (or yellow patch), also referred to as a Jewish badge, was a cloth patch that Jews were ordered to sew on their outer garments to mark them as Jews in public at certain times in certain countries, serving as a badge of shame.

The Suining government later told state media that it had revised the project, still recording social credit scores but abandoning the A-to-D classifications.

Despite the outcry in Suining, the central government seems determined to press ahead with its plans. Part of the reason is economic. With few people in China owning credit cards or borrowing money from banks, credit information is scarce. There is no national equivalent of the FICO score widely used in the United States, say, to evaluate consumer credit risks.

At the same time the central government aims to police the sort of corporate malfeasance that saw tens of thousands of babies hospitalised after drinking tainted milk and infant formula in 2008, and millions of children given compromised vaccines this year. Yet it is also an attempt to use the data to enforce a moral authority as designed by the Communist Party.

The Cyberspace Administration of China wants anyone demonstrating “dishonest” online behaviour blacklisted, while a leading academic has argued that a media blacklist of “irresponsible reporting” would encourage greater self-discipline and morality in journalism.

Under the social credit plan, the punishments are less severe — prohibitions on riding in “soft sleeper” class on trains or going first class in planes, for example, or on staying at the finer hotels, travelling abroad, or sending children to the best schools — but nonetheless far-reaching.

Under government-approved pilot projects, eight private companies have set up credit databases that compile a wide range of online, financial and legal information. One of the most popular is Sesame Credit, part of the giant Alibaba e-commerce company that runs the world’s largest online shopping platform. Tens of millions of users with high scores have been able to rent cars and bicycles without leaving deposits, company officials say, and can avoid long lines at hospitals by paying fees after leaving with a few taps on a smartphone.

Will it make things easier for users?

Last year, Ant Financial, an affiliate of Beijing e-commerce giant Alibaba, unveiled Sesame, which builds a credit score based on factors including the volume of purchases a customer makes with Ant’s Alipay payment system and whether a customer pays bills on time. Sesame Credit generates a social credit score for users based on “holistic” factors, such as credit history and social networks.

Users with higher scores are able to access benefits that run the gamut from waivers on car rental deposits to expedited airport security checks. Beyond Sesame Credit’s reward offerings, public social credit systems offer good-behavior benefits that can be minor conveniences like enhanced borrowing privileges at a local library, or free loaner umbrellas. But rewards can also have greater financial significance like expediting loan application approvals.

Conversely, poor scores result in penalties enforced against individuals or organizations that have committed wrongdoings — like traffic violations or late bill payments. And those rules are not just hypothetical. Parts of the social credit mechanism have already been put into practice. When rules are broken and not rectified in time, you are entered in a list of “people subject to enforcement for trust breaking” and you are denied access from things. Rules broken can lead to companies being unable to issue corporate bonds or individuals not being allowed to become company directors. According to a document released by China’s State Council, “trust-breakers” can face penalties on subsidies, career progression, asset ownership and the ability to receive honorary titles from the Chinese government.

In a similar vein, those who fail to repay debts are punished by travel restrictions. Just last month, the Supreme People’s Court announced that 6.15 million people in the country had been banned from air travel over the last four years for defaulting on court orders, according to local media. The Financial Times reported that some 6.73 million people were on a blacklist that had been in use by the court since 2013. To enforce penalties, the court announced it was working with a total of 44 government institutions to ensure that those blacklisted would be “limit(ed) … on multiple levels.”

Chinese government is very active with their plans to push its own fintech and AI industries. A substantial proportion of China’s population remains unbanked and parts of the economy are largely cash-based: Some 21 percent of the population did not have an account at a financial institution in 2014, according to the World Bank. A social credit regime could strengthen the credibility of the Chinese financial system by enforcing legal compliance and ultimately, building trust in the marketplace.

Despite that, backlash to the social credit system has been fierce with many Western media outlets highlighting the dystopian-sounding nature of the state taking a role in monitoring and policing citizen behavior.

Helping provide financial services to the underbanked

Ayannah, the leading provider of affordable and accessible digital financial services in Philippines has partnered with Bayad Center, the bills payment subsidiary of Meralco, the Philippines’ largest electric utility to launch Juan Credit, the first artificial intelligence-powered credit scoring system for the unbanked in emerging markets. Ayannah and Meralco aim to provide this huge segment of the population with better access to essential financial services such as personal loans, small business loans, home and auto loans as well as insurance products that will increase their quality of life.

JuanCredit will analyze unstructured data from various sources — bills payment, mobile tops, insurance premium payments, social media profiles — to provide meaningful credit scores for unbanked Filipinos and provide banks, financing companies, insurers and property developers with a system that will instantaneously and continuously update a borrower’s credit worthiness and insure sound underwriting.

Ayannah’s CEO Mikko Perez states, “We developed a software system that uses deep learning, a form of artificial intelligence technology that will analyze unstructured data to find recurring patterns of payment behavior that will indicate an individual’s willingness and ability to pay financial obligations promptly. This allows us to build credit scores even for individuals with little or no formal credit information but who may actually be good candidates to obtain credit.”

And it is the right step. Projects targeting specific needs of certain customer groups (and their behavior data) draw much attention too. SelfScore analyses credit histories of foreign students in the USA and derives credit scores (compare it to the British mobile bank Monese that targets expats). NovaCredit, meanwhile, works with immigrants in the USA, focusing on those from India and Mexico. There is an advantage in this focused approach — you can clearly see what information is relevant to your analysis when you narrow the scope of the query. In addition, targeted solutions appeal more to the clients.

Tallinn-based customer analytics startup DataDepot has tapped its first big clients in the United Kingdom and is now expanding its business in Asia. “Doing pilots with fintech and insurtech companies in Asia, we see potential to connect startups, enrich their CRMs with freely available insights about their customers and provide cross-sell marketplace to find look-alike customers in different markets,” co-founder Akim Arhipov said.

It is also seeing increasing demand for its fintech matching offer in Asia where “some of them have cheap and fast customer acquisition, but low margin and from another side high margin, but expensive CPA … It’s Tinder for fintech startups. I know what one thinks hearing this, but this is not your usual startup pitch — we are actually matching fintech startups with their peers and they can both benefit from the relationship.” The platform for fintech/insurtechs connects startups to leverage customer bases, co-operate and not compete (no operational costs for creating additional service/product), know more about their existing customers and attract similar ones using internal marketplace.

Banks in Asia are using customers’ smartphone data points, like how often they drain their battery, to determine whether or not they’re eligible for a loan. While this may sound like an unusual criteria for qualification, Singapore-based startup Lenddo thinks it can help people without traditional credit history borrow money. Lenddo chairman and founder Jeff Stewart said the company is already helping dozens of banks analyze data from millions of smartphones globally. He declined to name them, citing stipulations of their business agreements.

Using smartphones as data collection points

The 5-year-old firm’s software platform analyzes thousands of data points — everything from a smartphone user’s messaging and browsing activity, to the apps and Wi-Fi network they use. Factors like the cellular towers a phone pings are examined, too.

But what does all this have to do with credit scores? Take messaging, for example. Elements such as foreign language used and text length reveal behavioral patterns. While the battery level doesn’t matter too much in real time, the company looks at how that changes over a specific duration — that can convey how consistent someone is and how much they plan ahead.

Lenddo puts the data points into a complex proprietary algorithm, which computes how likely someone will default on a loan. Lenders then decide the default rate they want to accept. Banks either buy a license to use Lenddo’s software, which is pulled into an existing bank app, or Lenndo can build a separate app for the bank. It takes less than three minutes to calculate a rate through Lenddo.

While certain mobile behavior could impact the outcome of a credit score (like always running out of battery power), Stewart said extremely well-maintained smartphones raise a red flag in the system, too. “Our algorithm looks poorly upon someone who is too robotic,” said Stewart. “There’s a messiness to being human.”

Lenddo’s technology has helped banks make millions of dollars in loans since launching globally in January of 2015, he said. But its program is primarily used by lenders in emerging markets, such as Asia, Africa and Latin America. Most people in those regions don’t have traditional bank accounts or credit cards but access to a smartphone is increasingly greater.

The average size of a loan is about one month’s pay — in the Philippines that’s about US$400, says Stewart — with an average payback period of nine months. While the number of loans Lenddo has helped distribute so far isn’t public, the volume has grown more in the past month than in all of the fourth quarter of last year, he added.

Lenddo’s goal is to help 1 billion people get access to financial services by 2020. Even though Lenddo isn’t used in the U.S., insurance firms like Liberty Mutual and State Farm have started to adopt similar methodology to help determine car insurance discounts. For example, the companies have asked customers to submit information collected from their smartphones’ GPS, accelerometer and gyroscope to learn how people drive, brake and make turns.

The trend of using smartphone data to make financial decisions is expanding in other categories, too. Lenddo is already helping companies like Globe and Indosat, two telecommunications networks in the Philippines and Indonesia, become lenders.

A good credit score can help you get a loan easily. But what if you don’t have a credit score? The bank may look at your mobile connection — whether it is post-paid or pre-paid. Or whether you pay your utility bills regularly. Of if you are speaking to the same set of persons on a regular basis. These are some additional metrics that lenders today are looking at, in the absence of a traditional credit score.

According to Mayank Kachhwaha, co-founder of India Lends, a fintech company, a large number of first-time borrowers who apply for loans get rejected. “People without a loan have no credit history. As a result, they are declined by banks straightway,” he says. In such cases, data available through social media can replace conventional information. For instance, your LinkedIn profile can be used to verify your workplace. And data from your mobile devices, such as SMS regarding your financial transactions can be matched with bank statements.

IDFC Bank recently tied up with IndiaLends to offer instant approvals for personal loans for new to credit borrowers. According to an official from IDFC Bank, “Information on a new-to-credit customer is very thin. We have to establish identity, ability to pay and intent to pay.” The customer may be asked to log in through his social media identity, which will allow the platform to access the data. Or he may be asked to log in through his bank account. The data remains only with the bank and the fintech platform.

“The information is in the joint custody of IndiaLends and IDFC Bank. It has been agreed upon that that information will not be used for anything else,’’ says the IDFC Bank official.

If your bank statement shows that you pay electricity bills regularly, it will indicate a willingness to repay. A post-paid mobile connection also shows that you are someone who is willing to enter into a contract and honour it. This too will be a plus point in the eyes of lenders. “Sometimes people tend to overstate their income while applying for the loan. If one month’s salary slip shows a higher amount due to some tax calculation, for instance, that can be misleading. In such cases, looking into previous months’ bank statements will show the actual monthly salary,’’ says Kachhwaha.

Using non-traditional data solutions in predicting behaviour

Lenddo is another player in India that specialises in using non-traditional data solutions to predict customer’s behavior. “Banks use their traditional data along with our non-traditional data for three kinds of customers — New-to-credit customers, for choosing better customers and for internal customers who may have an account with the bank but no other credit relationship,’’ says Abhinav Haldia, Country Director, India, Lenddo.

Peer-to-peer lending marketplace i-Lend has partnered with Lenddo too. What are the indications of stability? Speaking to the same set of persons on a regular basis. Then, there is a visual psychometric test that can predict behaviour. For customers who are first-time borrowers or are seeking more loans at better rates, providing this data or going through this scrutiny can to be next step for improving scores.

Fair Isaac Corp., or FICO, announced that it will start letting nonfinancial information help determine scores. FICO, which is the creator of the most widely used scores in the U.S., says it isn’t planning on incorporating this data into credit scores for U.S. consumers. FICO, a global credit rating agency, has partnered with Lenddo, an expert in credit and verification technologies, to develop a credit risk score for consumers in India and to help facilitate loans for small businesses and individuals in India and Russia.

It will give lenders improved certainty around the risk assessment of people with ‘thin-files’ — those who don’t have enough data in their credit report to score. Richard Eldridge, co-founder and chief executive at Lenddo, said, “We believe that helping qualified low-and middle-income consumers gain access to credit will improve their lives and quite possibly transform Indian society. Defeating the need of a credit history to obtain a loan is essential to bring unserved but qualified consumers into the formal economy and giving them access to mainstream financial institutions.”

Jim Wehmann, EVP of Scores at FICO, said, “We see our partnership with Lenddo as a great synergy of analytics and scoring innovation, which we hope will give millions of creditworthy individuals access to credit. We already have received a very positive response in India from financial institutions, the regulators and government, and we look forward to announcing more very soon,” said Jim Wehmann, EVP of Scores at FICO.

Financial institutions, overcoming some initial trepidation about privacy, are increasingly gauging consumers’ creditworthiness by using phone-company data on mobile calling patterns and locations. The practice is tantalizing for lenders because it could help them reach some of the 2 billion people who don’t have bank accounts. On the other hand, some of the phone data could open up the risk of being used to discriminate against potential borrowers.

Phone carriers and banks have gained confidence in using mobile data for lending after seeing startups show preliminary success with the method in the past few years. Selling such data could become a more than US$1 billion-a-year business for U.S. phone companies over the next decade, according to Crone Consulting LLC.

The new credit-assessment methods could allow more people in areas without bank branches to open accounts online. They could also make credit cards and loans more accessible and prevalent in some parts of the world. In the past, lenders mainly relied on bank information, such as savings and past loan repayments, to judge whether to let someone borrow.

Some of the data financial institutions are using come directly from interactions with potential borrowers, while other information is collected in the background. FICO’s partner EFL sends psychological questionnaires of about 60 questions to potential borrowers’ mobile phones. With Lenddo’s technology, FICO can check if users’ phones were physically present at their stated home or work address, and if they are in touch with other good borrowers — or with people with long histories of fooling lenders.

In most cases, consumers must grant permission for their telecommunications records to be accessed as part of their risk assessment. One reason it’s taken the credit-risk industry some time to work out agreements with phone carriers or their representatives is because of negotiations over how to best protect client privacy. Companies are also concerned about making sure they don’t make themselves susceptible to claims of bias.

By checking phone records to see if a credit applicant associates with people with a poor track record of repaying loans, for example, lenders risk practicing discrimination on people living in disadvantaged neighborhoods. In addition, to comply with the Fair Credit Reporting Act in the U.S., a data provider must have a process in place for investigating and resolving consumer disputes in a timely manner — something that telecommunications carriers abroad may not offer.

Several years’ worth of data

Startups like Lenddo, Branch and Tala have collected several years’ worth of data to prove that their methods of using mobile-phone data work — and that customers flock to them for help. Started in 2011, Lenddo, for instance, spent 3 1/2 years giving out tens of thousands of loans, in the amount of $100 to $2,000, in the Philippines, Colombia and Mexico to prove out its algorithms. Its average default rate was in the single digits, CEO Richard Eldridge said in an interview. “The market is changing,” Eldridge said. “More and more people are seeing examples around the world of how non-traditional data can be used to enter into new market segments that couldn’t be served before.”

Also, Lenddo will give its own score for these borrowers which will give an additional yardstick for MFIs to assess them. The new service will cover individual MFI customers who live in urban areas and have an android phone. Leading MFIs will be on board within six to eight weeks, said Abhinav Haldia, country director (India) at Lenddo.

The new service will cover individual MFI customers who live in urban areas and have an android phone. Lenddo will give its own score for these borrowers which will give an additional yardstick for MFIs to assess them. At the end of March, about 62% of outstanding microfinance loans were in urban areas, according to data from Sa-Dhan, a self-regulatory MFI organization. “Our own analysis along with credit scores will help to quicken the loan process and increase the ticket size of the loan based on given risk,” said Haldia.

Haldia explained that as soon as the customer’s information is uploaded on a mobile or tablet by the MFI field officer, the customer receives a text message which gives a link to the loan application. Once the application is downloaded on the customer phone and the customer agrees to share data, Lenddo assesses creditworthiness using some of these data. These data points comprises of contacts, short messages services (SMS), call history and browsing behaviour.

MFIs over the last six to 12 months have begun using tablet-based solutions while travelling to remote locations and capturing know your customer (KYC) details of customers and avoid complicated paperwork. These new solutions have reduced the turnaround time required by these lenders, which has also helped in cutting operating costs. “In the future we expect to build a score which will be a combination of both traditional as well as non traditional tools,” said Haldia.

The company is planning to build an android application for its MFI partners in such a way that they can monitor their customers once an application is downloaded. The app will also send customers notifications regarding weekly or monthly payments. “It is a good move. Based on the historical records of the clients, loans can be tracked better,” said P. Satish, executive director of Sa-Dhan.

Russian startup named Scorista appeared on the international scoring arena in early 2017. From 2014 when company was established, it managed to capture most of the Russian scoring market by providing innovating approach to scoring of credit applications based on alternative data analysis. Awarded as “Best Scoring Solution” in 2016 by Bank Review Journal, service constantly provides its customers with new products.

Right now “smart risk management assistant” of Scorista consists of several unique solutions like automatic credit scoring based on alternative data sources, instant credit decision maker (approve or deny), collection scoring, verification plan and loan parameters selector.

The startup reached break-even point in 2016 — just after 18 months after it was established. Moreover, it successfully signed already more than 100+ clients, with The rapid growth of non-bank sector in global finance system is the main reason for that. In 2016 Scorista has processed more than 2.5M individuals from 100+ MFIs, compared to 600K from 30 MFIs in 2015.

A new approach to credit scoring

Russia, always known for its strong mathematical school, became the country of origin for the new approach of scoring. Scorista team created the technology that combines traditional and alternative scoring using machine learning. The average time to prepare a credit decision they achieved is a 10-15 seconds, depending on external data sources connection speed.

There are more than 3 billion worldwide are left without banking services due to the lack of their credit history or its poor state. The potential for success of Scorista in global markets with unbanked population is obvious — it has already successfully proved its reliability and effectiveness in Russia by specializing on non-bank lenders, allowing credit organizations to work with unbanked population due to an access to their alternative data sources.

Global expansion of service started in March 2017 from launching the operational office in China.“Similarity of Russian and Chinese non-bank lenders market will help us to capture at least 5 per cent of Chinese scoring market by 2020,” — said Maria Veikhman, CEO & Founder of Scorista. Representatives of the company declare that launch in USA and Kazakhstan scheduled on late 2017.